Coca-Cola company announce first quarter operating results

Taking into account first quarter volume performance in key markets and a slightly more conservative outlook due to economic indicators, the Company now expects unit case volume growth of 5 to 6 percent in the current year. This incorporates the anticipated benefits of heightened marketing activities, led by a new campaign for brand Coca-Cola, which will begin in the second quarter.

After considering the revised outlook for volume growth, the Company remains comfortable with full-year diluted earnings per share in the range of analysts' expectations. This estimate excludes any impact from transactional gains, as the Company views such items as nonrecurring in nature.

Regarding the longer-term outlook, Douglas N. Daft, chairman and chief executive officer, said, "We have recently concluded a thorough, disciplined process involving a comprehensive business analysis of all factors impacting our system, including the macroeconomic environment, demographic trends, consumption patterns, and the long-term financial returns of the Coca-Cola system. As a result of this exhaustive analysis, which we have reviewed with the Board of Directors, we have recalibrated our long-term performance objectives. We are confident that in the future we will be able to consistently achieve growth of company-owned, worldwide unit case volume in the range of 5 to 6 percent and earnings per share growth in the range of 11 to 12 percent, on a currency neutral basis."

For 2002, the Company anticipates that volume and earnings per share will grow in accordance with long-term objectives from a base earnings per share amount that excludes the previously announced 2001 incremental marketing activities.

Mr. Daft said, "Over the past year, we have strengthened our platform to deliver long-term shareowner value. More importantly, we will continue to do so over time. Our success will be driven not by short-term financial goals alone, but by our system's ability to capitalize on our key competitive advantages.

"The financial yardsticks we will use to measure ourselves, and by which we believe others will measure us, include our ability to deliver significant cash flows, strong operating income and attractive returns on capital well into the future. Coca-Cola has the most recognized beverage brands in the world and is able to reach consumers in nearly 200 countries through an unparalleled distribution system.

"Our core business has the potential for significant expansion and can realize that opportunity. For example, people outside the United States drink less than one serving of carbonated soft drinks a week. Within the U.S., consumers drink more than one serving a day. Therefore, we continue to aggressively drive the business and build on our competitive strengths, and we are confident this will produce sustainable growth in volume, earnings and cash flow, delivering outstanding financial returns for our system and our share owners," concluded Mr. Daft.

Volume Measurement

Consistent with industry practice, in the future, the Company's unit case volume information will only include unit case volume from operations which are majority-owned by The Coca-Cola Company. Therefore, after regulatory approvals are obtained, the Company intends to exclude volumes from the joint venture with Nestle and from the company it is forming with Procter & Gamble.

Had the Company excluded unit case volume contributed in the first quarter 2001 by brands which will be managed through equity investments in the future, worldwide unit case volumes would have grown 4 percent, reflecting no change.

Operational Review

First quarter worldwide unit case volume increased 4 percent. Worldwide gallon sales in the quarter increased 11 percent. Actual gallon sales were the equivalent of unit cases in the quarter; however, the percentage increase in gallon sales was higher than the increase in unit case volumes due to the reduction of concentrate inventory by certain bottlers during the first quarter of last year.

Asia - Unit case volume increased 10 percent for the quarter due to strong performance in most major markets, including China at 16 percent and India at 12 percent. Volumes within Japan grew by 1 percent, accelerating in the quarter to reach very strong growth in March as a result of solid marketing programs behind brand Coca-Cola and Georgia coffee. In the early part of the quarter, the Company's focus was on growing the highly profitable coffee business, which is weighted toward smaller package sizes. Gallon sales in Asia increased 34 percent in the first quarter 2001, as a result of the planned inventory reduction by selected bottlers in the first quarter 2000.

Latin America - First quarter unit case volume increased 3 percent. In Brazil, unit case volume increased 5 percent on top of 13 percent volume growth a year ago, driven by locally developed marketing activities. Mexico was impacted by extremely poor weather conditions early in the year; however, improving volume trends allowed for growth in the quarter of 1 percent on top of 8 percent growth last year.

In Argentina, the Company's strategy to offer greater diversity in its portfolio led to unit case volume growth of 14 percent. In Chile, volumes declined 1 percent due to low levels of consumer spending and difficult comparisons from the prior year. Gallon sales in Latin America increased 4 percent in the quarter.

North America - Unit case volume increased 1 percent in the first quarter, as major 2001 marketing initiatives are heavily weighted to the second, third and fourth quarters. New product launches have begun across North America, including Fanta, Manzana Mia, Planet Java, KMX, Minute Maid Lemonade and Fruit Punch and other products specifically tailored to consumer groups in each market. Gallon sales in North America increased 4 percent compared to the prior year.

Europe, Eurasia and Middle East - Unit case volume increased 4 percent. With the exception of Turkey and Germany, performance was solid across the entire region led by Central Europe, CCE Europe Territories and Southeast Europe. The Eurasia Division reported a decline in volumes of 14 percent due to the significant, continuing economic crisis in Turkey. Unit case volume growth in Germany was negatively impacted by retail pricing actions. The Company anticipates improving business results in Germany as the new management team, business strategies, and aggressive marketing activities combine with a bottling system which will be strengthened by the restructuring process now underway. Gallon sales in Europe, Eurasia and Middle East increased 12 percent for the year compared to the prior year.

Africa - First quarter unit case volume increased 10 percent, led by South Africa and Nigeria. In South Africa, local marketing initiatives and new product launches combined for successful unit case volume growth. In addition to cycling last year's volume decline resulting from a significant price increase, Nigeria experienced volume increases driven by new product and packaging launches. Gallon sales in Africa increased 33 percent compared to the prior year reflecting the impact of the planned concentrate inventory reduction by selected bottlers in 2000.

Financial Review

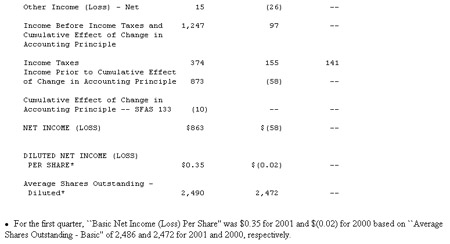

Fully diluted earnings per share were $0.35 for the first quarter. Revenues increased by 5 percent in the first quarter reflecting gallon shipments and price increases in selected countries, partially offset by structural change and the impact of foreign currencies. Structural change related to the sale of the Company's Japanese vending operation to local bottlers and the transfer of the German canning operation to Coca-Cola bottlers in Germany. Both events impacted revenues and cost of goods sold but had an immaterial impact on operating income.

Operating income for the first quarter 2001 increased significantly due to solid business results and the cycling of several nonrecurring items in the prior year. The impact of a stronger U.S. dollar reduced our operating income by approximately 3 percent during the first quarter, led by movements in the Euro, Brazilian real, Australian dollar and South African rand. Excluding the nonrecurring items in the prior year first quarter, net income grew by 11 percent.

In the first quarter 2000, a reduction in concentrate inventory by certain bottlers impacted the Company's diluted earnings per share by approximately $0.10 after tax. Reported operating income for the first quarter 2000 was also impacted by nonrecurring charges of $0.08 per share after tax due to the Company's organizational realignment and $0.16 per share after tax primarily related to the write-down in the carrying value of the Company's Indian bottling operations.

The Company reinitiated its share repurchase program during the first quarter 2001, reflecting improving cash flow trends. During the quarter, the Company repurchased over 1 million shares of common stock at an average cost of $50.54 per share. Since the inception of our initial share repurchase program in January 1984, the Company has repurchased over 32% of common shares then outstanding, or a cumulative total of over 1 billion shares at an average cost of approximately $12.51 per share.

Accounting Standards

During the quarter, the Company implemented SFAS 133, "Accounting for Derivative Instruments and Hedging Activities," and the cumulative effect of the accounting change was a one-time, non-cash charge of $10 million. The application of this new accounting standard in the first quarter 2001 decreased earnings by $16 million on a pre-tax basis.

In the first quarter, the Company adopted the provisions of the Emerging Issues Task Force (EITF) issue No. 00-14 "Accounting for Certain Sales Incentives," and issue No. 00-22 "Accounting for Points and Certain Other Time-Based Sales Incentive Offers, and Offers for Free Products or Services to Be Delivered in the Future." The adoption of both EITF No. 00-14 and EITF No. 00-22 resulted in the reclassification of $135 million for first quarter 2000, from selling, administrative and general expenses to a reduction in net revenues. The amount reclassified relates primarily to volume incentives offered to customers by The Minute Maid Company.

Conference Call

The Company will host a conference call to discuss the first quarter 2001 earnings release with financial analysts on April 18, 2001 at 1:00 p.m. (EDT). To listen, please visit the Investor Relations section of the Company's website at www.coca-cola.com.

This press release contains statements, estimates or projections, not historical in nature, that may constitute "forward-looking statements" as defined under U.S. federal securities laws. These statements, which speak only as of the date given, are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks include, but are not limited to, our ability to finance expansion plans, share repurchase programs and general operating activities; changes in the non-alcoholic beverages business environment, including actions of competitors and changes in consumer preferences; regulatory and legal changes; fluctuations in the cost and availability of raw materials; interest rate and currency fluctuations; changes in economic and political conditions; our ability to penetrate developing and emerging markets; the effectiveness of our advertising and marketing programs; litigation uncertainties; adverse weather conditions; and other risks discussed in our Company's filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report on Form 10-K, which filings are available from the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements.

SOURCE: Coca-Cola Company